By Kushan Niyogi

Ukraine’s cities have already bore the brunt of war and invasion, as Russia proceeds further into the Ukrainian mainland. As of now, numerous stories have emerged ranging from scores of Ukrainian citizens arming themselves to aid in the fight against Russian invaders, to a ghost fighter jet defending Ukraine’s skies.

It is fairly difficult to evaluate fact from fiction as the myths pile up, one on top of the other. However, what is not fiction is the absolutely gargantuan economic sanctions placed on Russia by the rest of the world.

The sanctions are aimed at decimating the entirety of the sizeable Russian economy. However, it has been fairly perceived that the sanctions may not affect them as much as the SWIFT blockade will.

The question the world wants to know the answer to is: how will an economic move hurt the invading country? And, much like every other question, it deserves to be answered.

What Is The SWIFT Blockade?

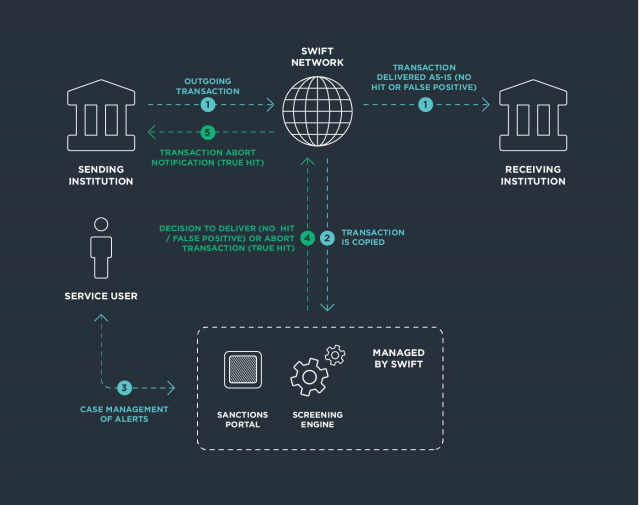

The whole of the banking sphere works on the basis of a certain system that ensures rapid transactions, and transfer of funds from point A to B. This system is referred to as the “Society for Worldwide Interbank Financial Telecommunication” (SWIFT).

Essentially, it is a secure messaging system essential for cross-border trade. Suffice to say, this system forms the backbone of international trade which, eventually, forms the economic stronghold of a country.

As of now, numerous countries have declared that they will be targeting select Russian banks to place the blockade upon. However, as of now, none of the NATO (North Atlantic Treaty Organization) ally states have specified the banks which are going to be affected by the blockade.

It must be stated, however, that the SWIFT blockade will have extraneous effects on the entirety of global polity, and I believe that it will become the unbecoming of Russia.

To put matters into perspective, the blockade will result in the affected Russian banks facing difficulty initiating transactions even with their allies, such as China. This will eventually lead to slow trade and costlier transactions.

How Will The SWIFT Blockade Affect Russia?

Numerous analysts have stated that the result of the blockade will only have a massive impact on the Russian banks selected by the other countries.

As Edward Fishman, an expert at the Eurasia Center of the Atlantic Council think tank, stated that, “The devil will be in the details. Let’s see which banks they select.”

As elaborated by numerous such experts, it all boils down to the banks the nations are willing to target. Targeting banks such as Sberbank, VTB and Gazprombank, will result in a crushing attack on the Russian financial sphere.

However, the sanctioning of specific banks may result in “nesting”. This essentially means that owing to such measures, Russian personnel may be inclined to take refuge in non-sanctioned banks and large multinationals to encounter the international market.

Kim Manchester, the managing director of ManchesterCF Financial Intelligence, stated that the development would be a “dagger into the heart of Russian banks.”

Elaborating further, Manchester stated that the American President, Joe Biden’s sanctions would be effective in the long run, as the selectivity of it still leaves space for fair diplomacy, as it does for the imposition of a blanket ban.

Impact On The Russian Economy

It has been estimated that the sanctions may result in the absolute collapse of the Russian economy, and more specifically, its banking system. The said blockade may result in the Russian ruble taking a terrible hit, as markets open for the financial week.

Furthermore, it has been predicted by Sergey Aleksashenko, a former deputy chairman of the (central) Bank of Russia, that the scenario will lead to the disappearance of imports to Russia.

He stated that, “This is the end of a significant part of the economy. Half the consumer market is going to disappear. These goods will disappear if payments can’t be made for them.”

These predictions only make it more difficult to side with the Russian government at the moment. It must be stated, however, that many Russian banks have already introduced an alternative to the SWIFT services in the form of “System for Transfer of Financial Messages” (SPFS).

The SPFS sent around 2 million messages in 2020, and according to the Bank of Russia, it aims to raise its share to 30% by 2023. However, as of now, most financial transactions and communications still take place through the SWIFT messaging services.

It has been a fact of modern age warfare that it is the side that sways the finances to its whims that actually wins the war. The SWIFT blockade might just serve as an awakening for countries to leave their nuclear weapons in their warehouses to catch dust, as they strengthen their banking system to a T.

__

Note: This article was originally published here.